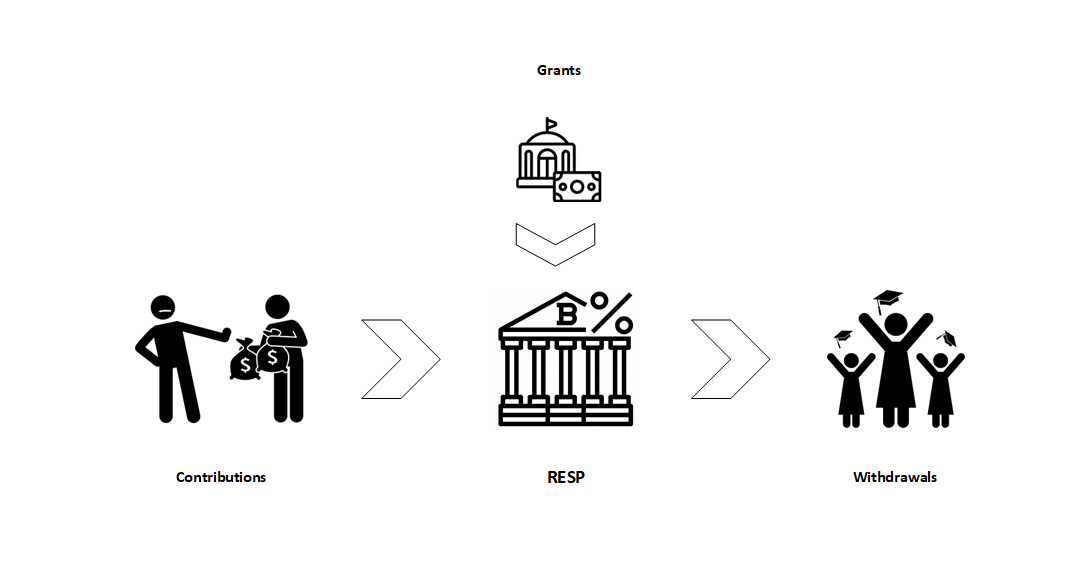

Transactions

- Contributions

- Grants

- Withdrawals

- Plan Termination

Contributions

A subscriber can make a contribution for a beneficiary under the plan if the beneficiary is a resident in Canada and the beneficiary’s SIN has been provided to the promoter of the plan.

Contributions to an RESP are not deductible from the subscriber’s income. Control of the contributions remains with the subscriber and may be withdrawn tax-free at any time. Note that a withdrawal may require repayment of government incentives and may result in the beneficiary being ineligible for additional incentives.

The subscriber is responsible for making sure that the contribution limits are not exceeded.

There is a lifetime contribution limit of $50,000 that can be contributed to all RESPs for a designated beneficiary. Since 2007, There is no annual limit for contributions to RESPs.

Government grants and incentives made to an RESP under the Canada Education Savings Act or under a designated provincial program are not considered part of the lifetime limit.

The final contribution must be made by the end of the 31st year after the year the plan is entered into, or earlier if amounts have been transferred from an existing RESP. In addition, for a family plan, the final contribution must be before the beneficiary’s 31st birthday.

For a specified plan, no contributions (except transfers from another RESP) may be made to the plan after the 35th year following the year the plan was entered into, and the plan must be terminated by the end of the 40th year after the year the plan was opened.

An excess contribution occurs at the end of a month when the total of all contributions made by all subscribers to all RESPs for a beneficiary is more than the lifetime limit ($50,000) for that beneficiary.

Each subscriber for that beneficiary is liable to pay a 1% per-month tax on the subscriber’s share of the excess contribution that’s not withdrawn by the end of the month. The tax is payable within 90 days after the end of the year in which There is an excess contribution. An excess contribution exists until it is withdrawn.

Subscribers have to file CRA Form T1E-OVP, Individual Income Tax Return for RESP Excess Contributions, to calculate the amount of tax you have to pay on your share of the excess contribution for a year.

Note: The amount subject to tax can be reduced by withdrawing the excess contributions. However, in determining whether the lifetime limit has been exceeded, the withdrawn amounts are included as contributions for the beneficiary even though they’ve been withdrawn.

Government Grants & Incentives

Grants and incentives are available from the Government of Canada as well as some provincial governments to assist and encourage parents or guardians to plan and save for their children’s post‑secondary education.

Note: Not all plans support all government programs. Check with the promoter for the incentives that are offered with their RESP.

The federal government provides incentives under the Basic and Additional Canada Education Savings Grant and Canada Learning Bond programs. These programs are administered by Employment and Social Development Canada (ESDC). You must apply for each of these separately.

Canada Education Savings Grant (CESG)

The Canada Education Savings Grant, or CESG, provides up to a lifetime maximum of $7,200 to an RESP per child. Contributions must be made to the RESP to receive the CESG. Payment is made in the month following the month that the contribution is made.

The CESG has two parts:

- Basic Canada Education Savings Grant – provides 20% on every dollar of the first $2,500, up to $500, on contributions to the child’s RESP each year regardless of family income, capped at the lifetime maximum.

- Additional Canada Education Savings Grant – depending on the primary caregiver’s net family income, the child’s RESP could receive an extra 10% or 20% on every dollar of the first $500 you contribute to the child’s RESP each year.

The CESG is available only on the first $2,500 of contributions per year per child (to a maximum of $500). The grant room accumulates from birth until the end of the year that the child turns 17—even if the child is not a beneficiary of an RESP. Unused basic CESG amounts for the current year are carried forward. If you have available carry forward grant room, the CESG is available on up to $5,000 in contributions per year (to a maximum of $1,000).

All children resident in Canada (up to the end of the calendar year in which they turn 17), and have a Social Insurance Number (SIN), are eligible to receive CESG from the federal government for their post-secondary education if an RESP has been opened for them. Adults are not eligible for these grants.

However, to receive the CESG after age 15, one of the following contributions must have been made to the RESP (and not withdrawn) by December 31 of the calendar year in which the child turns 15:

- Total contributions of at least $2,000 in total contributions to all RESPs on behalf of the child

- Contributions of at least $100 a year or more in any four previous years to an RESP on behalf of the child. The contributions do not need to be consecutive years.

Canada Learning Bond (CLB)

The Canada Learning Bond, or CLB, is an additional federal government incentive of up to $2,000 lifetime administered by Employment and Social Development Canada (ESDC), to help modest-income families set up RESPs and save for children born after 2003. The CLB will be deposited directly into the RESP. No contributions to the RESP are needed to obtain the CLB.

The initial grant is $500 plus an additional $25 to cover the administrative cost of opening an RESP. Thereafter, for each year of eligibility, the grant is $100 per year until the child reaches age 15.

The CLB is retroactive. The CLB amounts accumulate each year of eligibility until December 31 of the year in which the beneficiary turns 15. The primary caregiver can request the CLB for an eligible child until the day before they turn 18. Once the child turns 18, they could also become the subscriber of their own RESP and request the CLB for themselves, until the day before they turn 21.

If the beneficiary does not pursue post-secondary education, the CLB is returned to the government.

- Available to individual, sibling, or family plans

- Beneficiary(s) must meet the following conditions:

- born January 1, 2004 or later

- have a birth certificate

- have a social insurance number (SIN)

- be a Canadian resident

- be a beneficiary under an RESP

- Eligibility for the CLB is based on the adjusted family income of the primary caregiver. The threshold is set by the government and is indexed annually.

- As well, the primary caregiver of the beneficiary must:

- have filed income tax returns for each year they wish to request the CLB for the beneficiary

- be eligible to receive the Canada Child Benefit (CCB)

Some provinces have also introduced incentive programs to assist families in saving for their children’s post-secondary education.

Alberta Centennial Education Savings (ACES) Plan

NOTE: On March 26, 2015, the Government of Alberta announced the closing of the Alberta Centennial Education Savings (ACES) Plan. Promoters must convert all ACES held in RESPs into accumulated income on January 1, 2016.

British Columbia Training and Education Savings Grant (BCTESG)

The British Columbia government will contribute one time payment of $1,200 to eligible RESP through the B.C. Training and Education Savings Grant (BCTESG). The BCTESG requires no matching or additional contributions.

- Available to individual or family plans.

- Beneficiary must meet the following conditions:

- parent and child must be residents of B.C.

- child must have been born in 2006 or later

- child must have a social insurance number (SIN)

- child must be named as beneficiary of an RESP with a participating financial institution

- child may apply for the grant between their 6th birthday and the day before they turn 9

Quebec Education Savings Incentive (QESI)

The Quebec Education Savings Incentive (QESI) is a tax measure that encourages Québec families to start saving early for the post-secondary education of their children and grandchildren. The lifetime maximum that can be received from the QESI is $3,600 for eligible beneficiaries.

This measure consists of a refundable tax credit. The credit is paid directly into a registered education savings plan (RESP) opened with an RESP provider that offers the QESI. Payment is made in the year following the year of the contribution.

The QESI has two parts:

- Basic Quebec Education Savings Incentive – provides 10% on every dollar of the first $2,500, up to $250, on contributions to the child’s RESP each year regardless of family income, capped at the lifetime maximum.

- Additional Quebec Education Savings Incentive – an amount of up to $50 per year, calculated based on family income of the beneficiary, may be added to the basic amount.

Since 2008, accumulated rights from previous years can increase the basic amount, up to an additional $250 per year. However, the basic amount cannot exceed $500 per year.

In order for the Québec education savings incentive (QESI) to be paid into a child’s RESP for a given taxation year, the child must meet all of the following conditions:

- be less than 18 years old

- have a social insurance number (SIN)

- be resident in Québec on December 31 of the taxation year

- be designated a beneficiary of the concerned registered education savings plan (RESP)

Saskatchewan Advantage Grant for Education Savings (SAGES)

NOTE: The Saskatchewan Advantage Grant for Education Savings (SAGES) program has been suspended as of January 1st, 2018, and is being wound down. Promoters must convert all SAGES held in RESPs into accumulated income on September 1st, 2023.

In 2013, the Government of Saskatchewan introduced the Saskatchewan Advantage Grant for Education Savings (SAGES) administered in partnership with Employment and Social Development Canada (ESDC).

SAGES is an education savings incentive that is paid into an eligible RESP at a rate of 10% of RESP contributions, up to $250 per beneficiary for each eligible year, until the end of the calendar year in which a beneficiary turns 17. Total SAGES payments per beneficiary could reach $4,500 if the beneficiary is eligible from birth until age 17.

Accumulated rights from previous years can increase the basic amount, up to an additional $250 per year. However, the annual amount cannot exceed $500 per year.

In order for the Saskatchewan Advantage Grant for Education Savings (SAGES) to be paid into a child’s RESP for a given taxation year, the child must meet all of the following conditions:

- RESP contribution made on or before December 31 of the year in which the beneficiary turns 17

- have a social insurance number (SIN)

- be resident of Saskatchewan when the RESP contribution was made

RESP contributions made during the calendar year in which the beneficiary turns 16 or 17 years of age must satisfy one of the following conditions to be eligible for SAGES:

- a subscriber makes a minimum of $100 in annual RESP contributions in respect of the beneficiary, and they are not withdrawn. This can be done in any 4 years (consecutive or not), by December 31 in the year the beneficiary turned 15, or

- a subscriber makes a minimum of $2,000 in RESP contributions in respect of the beneficiary, and they are not withdrawn. This has to be done by December 31 in the year the beneficiary turned 15.

Payments & Withdrawals

The promoter can make the following types of withdrawals:

- Payments to beneficiary or subscriber:

- When the beneficiary is enrolled in a qualifying post-secondary educational program:

- educational assistance payment (EAP)

- post-secondary education (PSE) withdrawal

- When the beneficiary does not enroll in post-secondary education:

- refund of contributions to the subscriber

- accumulated income payment (AIP)

- repayment of amounts under the Canada Education Savings Act or under a designated provincial program

- When the beneficiary is enrolled in a qualifying post-secondary educational program:

- Transfers:

- transfer from one RESP to another RESP

- transfer RESP investment income to an RDSP

- Payment to a designated educational institution in Canada

| Scenario | Withdrawal Type | Source | Taxation |

|---|---|---|---|

| Student beneficiary enrolls in post‑secondary education | Post-secondary education (PSE) contribution withdrawal | RESP contributions | Returned tax-free to subscriber |

| Educational assistance payment (EAP) | RESP earnings, CESG, and other incentives | Taxable to student beneficiary at the student’s marginal tax rate | |

| Student beneficiary does not enroll in post-secondary education | Contribution withdrawal (CW) | RESP contributions | Returned tax-free to subscriber |

| Accumulated income payment (AIP) | Earnings on contributions, grants, and incentives | Paid to subscriber and taxable at the subscriber’s marginal tax rate, plus an additional 20% tax |

CESG: unused grants returned to government; no tax consequences

CLB: returned to government; no tax consequences

An RESP offers two types of payment options for educational purposes based on the types of monies in the plan.

- Educational Assistance Payment (EAP) consisting of the government incentives as well as earnings on the investments and incentives

- Post-secondary education (PSE) contribution withdrawal

An EAP is the amount paid to or for a beneficiary (the student) from an RESP to help finance the cost of post-secondary education.

An EAP consists of government grants, incentives, and the earnings on the investments and incentives.

The student includes EAPs as income on the tax return for the year the student receives them.

The promoter can only pay EAPs to or for a student if one of the following situations applies:

- The student is enrolled in a qualifying educational program. This includes students attending a post-secondary educational institution and those enrolled in distance education courses, such as correspondence courses, provided by such institutions.

- The student has reached the age of 16 years and is enrolled in a specified educational program.

A beneficiary may receive EAPs for up to six months after ceasing enrolment, provided that the payments would have qualified as EAPs if the payments had been made immediately before the student’s enrolment ceased.

A qualifying educational program is an educational program at a post-secondary school level that lasts at least three consecutive weeks and requires a student to spend no less than 10 hours per week on courses or work in the program.

A specified educational program is a program at a post‑secondary school level that lasts at least three consecutive weeks and that requires a student to spend not less than 12 hours per month on courses in the program.

A post-secondary educational institution includes:

- a university, college, or other designated educational institution in Canada

- an educational institution in Canada certified by ESDC as offering non-credit courses that develop or improve skills in an occupation

- a university, college, or other educational institution outside Canada that has courses at the post-secondary school level at which the beneficiary was enrolled on a full‑time basis in a course of not less than three consecutive weeks.

| Full-time | Qualifying educational program | First 13 consecutive weeks | $8,000 maximum |

| After first 13 consecutive weeks | No limit | ||

| Part-time | Specified educational program | Each 13-week period | $4,000 maximum |

If there is a 12-month period when the student is not enrolled in a qualifying educational program for 13 consecutive weeks, the $8,000 maximum applies again. For studies in a specified educational program, the limit is $4,000, for the 13-week period, whether or not the student is enrolled in such a program throughout that 13-week period.

ESDC may, on a case-by-case basis, approve an EAP amount of more than the above limit if the cost of tuition plus related expenses for a particular program is substantially higher than the average.

A PSE withdrawal may be made by the subscriber when a beneficiary is eligible for an EAP and may be used for any purpose.

Note: This type of withdrawal of the subscriber’s contributions while the beneficiary qualifies for an EAP does not incur a CESG clawback.

Subject to the terms and conditions of the RESP, a portion of the contributions withdrawn can be paid to the beneficiary to supplement the EAP. There is no limit on the dollar amount for a PSE withdrawal.

If the beneficiary does not enroll in a post-secondary educational program and if another beneficiary is not named, the terms of the RESP may offer options to withdraw the RESP property for non-education purposes.

- Contributions can be returned tax-free to the subscriber at any time.

- Accumulated income payments that are taxable payments consisting of investment earnings may be paid, under specified conditions, to the subscriber.

- Amounts received under the Canada Education Savings Act or under a designated provincial program may need to be repaid to the applicable government.

Tip: If the beneficiary does not enroll in a post-secondary educational program right away, you can also wait before withdrawing funds and terminating the plan. RESPs can remain open for 36 years (40 for a specified plan). The beneficiary may decide to enroll in post-secondary education at a later time.

[1] The withdrawal of assisted contributions from a RESP after March 22, 2004 will result in a beneficiary being ineligible to receive any CESG for the balance of the year and the next two years. A withdrawal of pre-1998 contributions will cause all beneficiaries under the plan to be ineligible for any CESG in the calendar year that the withdrawal was made and for the following two calendar years.

An AIP consists of earnings on contributions to the RESP and earnings on the CESG and other additional government incentives.

It is important to carefully review the terms and conditions of any RESP, as the treatment of accumulated income varies.

AIPs can be made to or for only one subscriber and cannot be made as a single joint payment to separate subscribers. When more than one individual is entitled to receive accumulated income payments from the plan, the payments must be made separately to each person.

An RESP may allow for AIPs when the following conditions are met:

- recipient must be a Canadian resident

- recipient must be a subscriber of the RESP

- any one of the following:

- The RESP must have been in existence for at least 10 years, and the current and former beneficiaries must be at least 21 years of age and not eligible to receive an EAP.

- Each individual who was a beneficiary is deceased.

- The RESP is in its final year.

Note: The CRA may waive the age and 10 year maturity conditions, if it is reasonable to expect that a beneficiary under the RESP will not be able to pursue post-secondary education because the beneficiary suffers from a severe and prolonged mental impairment. Such requests have to be made by the RESP promoter in writing.

Note: AN RESP must be terminated by the end of February of the year after the year that the first AIP is paid.

The recipient has to include the AIP as income on the tax return for the year it is received. An AIP is subject to two different taxes:

- the regular income tax, and

- an additional tax of 20% (for residents of Quebec, 12% federal plus 8% provincial).

Federal and provincial government grants can only be used to pay for post-secondary education. If they cannot be used for educational purposes, they must be returned to the government.

Transfers of property between RESPs are generally not restricted.

Reducing the amount of AIPs subject to tax:

- An individual plan can be transferred to any other individual plan.

- An RESP can be transferred to a plan with a different subscriber but the same beneficiary.

- A family plan can be split into individual plans or individual plans can be combined into a family plan.

Note: A direct transfer cannot be made from an RESP that has made an AIP.

Tip: The receiving plan must be registered with CRA before the funds are transferred. If not, the transferring plan will be considered as having been paid to the subscriber as an AIP.

Note: Transfers can result in an excess contribution. This is because the contribution history from the transferring plan is also transferred to the receiving plan. Each contribution is treated as if it had been made into the receiving RESP; therefore, the contribution history is added to the receiving plan beneficiary’s contribution history. If this combined contribution history exceeds the receiving plan beneficiary’s lifetime limit, there could be an excess contribution. In addition, each subscriber under the transferring RESP is treated as a subscriber under the receiving RESP. This means that the subscriber is liable for any tax on excess contributions.

Transfers from one RESP to another RESP can be made without resulting in any tax penalties in the following cases:

- There is a common beneficiary under the transferring plan and the plan receiving the transfer.

- A beneficiary under the transferring plan is a sibling of a beneficiary under the receiving plan and one of these situations applies:

- the receiving plan allows more than one beneficiary under the plan

- the beneficiary under the receiving plan was under 21 years of age at the time the receiving plan was entered.

The effective date of the plan where funds have been transferred, whether it is a partial or total transfer, will be the earlier of:

- the effective date of the plan the funds came from; and

- the effective date of the plan the funds were transferred to.

Note: The effective date is relevant in determining when contributions and transfers to an RESP must end, when accumulated income payments can start and when the plan must be terminated.

A subscriber of an RESP that allows AIPs and a holder of an RDSP may jointly elect in form RC435 Rollover from a Registered Education Savings Plan to a Registered Disability Savings Plan to transfer an AIP under the RESP to the RDSP if, at the time of the election, the RESP beneficiary is also the beneficiary under the RDSP.

To qualify for an RESP rollover, the beneficiary must meet the existing age and residency requirements in relation to RDSP contributions. Also, one of the following conditions must be met:

- the beneficiary is, or will be, unable to pursue post-secondary education because of a severe and prolonged mental impairment

- the RESP has been in existence for more than 35 years; or the RESP has been in existence for at least 10 years, and each beneficiary under the RESP has attained 21 years of age and is not eligible to receive educational assistance payments.

The accumulated income payment rollover to an RDSP will not be subject to regular income tax or the additional 20% tax.

When an RESP rollover occurs, contributions in the RESP will be returned to the RESP subscriber on a tax-free basis. Also, grants and incentives must be repaid to the applicable government and the RESP terminated by the end of February of the following year.

The investment income rolled over to an RDSP:

- will be considered a private contribution for the purpose of determining whether the RDSP is a primarily government-assisted plan (PGAP) but will not attract Canada disability savings grants (CDSGs)

- will be included in the taxable portion of RDSP withdrawals made to the beneficiary

- may not exceed and will reduce the RDSP contribution lifetime limit.

An investment income rollover cannot be made if the beneficiary:

- is not eligible for the disability tax credit (DTC)

- is deceased

- is over 59 years of age in the year of the contribution

- is not a resident of Canada.

An RESP may provide for payments to be made to a Canadian designated educational institution or to a trust for such an institution at any time.

For example, payments could occur when the plan is left with only a small amount of cash after the subscriber withdraws the contributions as a refund of contributions and one or more of the requirements for AIPs are not met.

Plan Termination

An RESP may be terminated at any time, subject to the terms of the plan provider. However, an RESP must be terminated on or before the last day of the 35th year following the year that the plan was entered, or the 40th year for a specified plan. A specified plan is essentially a single beneficiary RESP (non-family plan) under which the beneficiary is entitled to the disability tax credit for the beneficiary’s tax year that includes the 31st anniversary of the plan.

When the RESP is terminated, the assets can be paid out in the following manner:

Contributions are returned tax-free to the subscriber.

Federal and provincial government grants are returned to the government, as this money can only be used to pay for post-secondary education.

There are a few options:

- Accumulated Income Payment (AIP). For a family or individual RESP, investment earnings can be paid to the subscriber as an AIP. The subscriber has to pay tax on any AIP received from the plan plus a 20% additional tax.

- Payment to a Designated Educational Institution. If the criteria for an AIP are not met, the earnings can be paid to a designated educational institution.

- Transfer to an RESP. The regular tax can be deferred, and the additional tax can be avoided where up to $50,000 is transferred as a contribution to the RRSP of the subscriber or a spousal RRSP, provided the subscriber has sufficient contribution room.

- Remains with Group RESP. For a group RESP, if the subscriber drops out or cancels the plan before it matures, the investment earnings stay in the plan and are shared with the remaining beneficiaries of the group when the plan matures. Depending on the terms of the plan, it may be possible to transfer the RESP savings to an individual plan.

Note: If the beneficiary does not attend post-secondary education immediately, the plan can be left open to accumulate tax-free should the beneficiary reconsider at a later date.