RESP Basics

- How an RESP Works

- Type of RESPs

- Investments

- Costs and Fees

How an RESP works

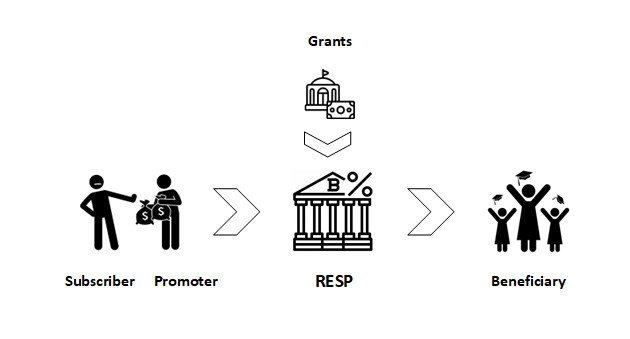

Here is an overview of how an RESP generally works:

- A subscriber enters into an RESP contract with the promoter and names one or more beneficiaries under the plan.

- The subscriber makes contributions to the RESP. Government grants (if applicable) will be paid to the RESP.

- The promoter of the RESP administers all amounts paid into the RESP. The promoter also makes sure payments from the RESP are made according to the terms of the RESP.

- The promoter can return the subscriber’s contributions.

- The promoter can make payments to the beneficiary to help finance their post-secondary education.

- The promoter can make accumulated income payments.

The subscriber is the individual who sets up the RESP, names one or more beneficiaries, and makes contributions to it. Generally, the subscriber of the plan cannot be changed after the plan has been set up.

You can change a subscriber by way of plan transfer. For example, where the grandparents have opened the original plan and wish to transfer the ownership to the parents of the beneficiaries.

The subscriber is responsible for making sure that the contribution limits are not exceeded. Control of the contributions remains with the subscriber. However, contributions may be paid to the beneficiary by or on behalf of the subscriber.

A subscriber must be an individual; corporations and trusts are not allowed to be a subscriber (unless the trust is the estate of a deceased subscriber). All subscribers of an RESP must provide their SIN to the promoter before the plan can be registered as an RESP.

- You can be a single subscriber.

- You and your current or former spouse or common-law partner can be joint subscribers.[1]

- A public primary caregiver of a beneficiary may also be a subscriber. A public primary caregiver may be the department, agency, or institution that cares for the beneficiary; or the public trustee or public curator of the province in which the beneficiary resides.

For an individual plan, there are no restrictions on who can be the original subscriber under an RESP. Anyone (parents, grandparents, or other relatives and friends) of any age can open an RESP and name a beneficiary. You can even set up an RESP for yourself. For a family plan, the subscriber must be connected by blood or adoption to all plan beneficiaries.

[1] Current or former spouses (divorced or separated) can open a RESP account as joint subscribers. The latter option was introduced as part of the 2023 Federal Budget.

Changes to the subscriber are allowed in the following situations:

- A former spouse or common-law partner can become a subscriber based on a court order or written agreement for dividing property after a breakdown of the relationship.

- Another individual or another public primary caregiver who has, under a written agreement, acquired a public primary caregiver’s rights may become a subscriber.

- If there are joint subscribers, the survivor would continue as the subscriber of the RESP. An individual can be named as successor subscriber and will become the subscriber after the death of the last surviving subscriber. Otherwise, the executors of the subscriber’s estate may assume this responsibility.

You will need to check the terms and conditions of your RESP for changes that are allowed under the terms of the plan.

The promoter is the person or organization that offers the education savings plan (ESP) and applies to CRA for registration as an RESP at the request of the subscriber.

The promoter arranges to hold the funds with a trust company licensed in Canada.

The promoter administers all amounts paid into the RESP to pay EAPs to or for one or more plan beneficiaries.

A beneficiary (future student) of an RESP is an individual named by the subscriber and to whom, or on whose behalf, the promoter agrees to make educational assistance payments. There are no limits on the number of plans you can establish for a beneficiary, or the number of RESPs a beneficiary may have. However, the annual and lifetime contribution limits are per beneficiary and not per RESP account.

A beneficiary must have a SIN and be resident in Canada when the designation is made.[1] Contributions can be made only for beneficiaries who are resident in Canada, and only resident beneficiaries are eligible for the government incentives.

In an individual plan, there is no restriction on who can be the beneficiary. Only one beneficiary is allowed and there is no age restriction. You can be the beneficiary of your own RESP.

In a family plan, there can be one or more beneficiaries and each beneficiary must meet both of the following conditions:

- The beneficiary must be connected by blood relationship or adoption to each living subscriber; or have been similarly connected to a deceased original subscriber.

- The beneficiary must not have reached 21 years of age at the time of being named as a beneficiary. When one family plan is transferred to another, a beneficiary who is 21 years of age or older can still be named a beneficiary to the new RESP.

Connected by blood or adoption refers to a parent, brother, sister, child, or grandchild of the subscriber. This does not include the subscriber’s nieces, nephews, aunts, uncles, or cousins. Adoption refers to a child adopted legally or in fact. Stepchildren are considered to be connected to their stepparent.

[1] Effective January 1, 2004, an individual cannot be designated as a beneficiary unless the individual’s SIN has been provided to the promoter of the plan and the beneficiary is a resident in Canada. There are exceptions for beneficiaries of RESPs entered into before 1999 and in limited cases, for transfers from another RESP for the same non-resident beneficiary.

You can name an alternate beneficiary if the terms of the plan allow it. This applies to both individual and family plans. If you have a group plan, check the terms of the plan to find out if you can change beneficiaries or transfer the plan to another beneficiary.

All contributions made to the plan for the previous beneficiary are treated as if they had been made for the new beneficiary on the date they were originally made. This can cause an overcontribution penalty unless:

- the new beneficiary is under 21 years old and a sibling of the former beneficiary, or

- both beneficiaries are under 21 years old and related to the original subscriber.[2]

Some government incentives, up to the maximum per beneficiary, may be transferable to a sibling. Otherwise, they are returned to the government if the beneficiary does not pursue an education at a qualifying post-secondary institution.

[2] The provision permitting the designation of non-related beneficiaries in contracts established prior to July 14, 1990 has been exempted. In this situation, you’ll be able to keep this beneficiary in your plan and contribute for the beneficiary’s post-secondary education but your plan will not be entitled to any CESG.

For an individual plan, you may be able to name a new beneficiary. For a family plan, the RESP continues with the remaining beneficiaries.

The plan will be terminated if all plan beneficiaries are deceased, and a replacement beneficiary cannot be made.

Types of RESPs

There are three types of registered education savings plans (RESPs) to choose from:

- individual plans

- family plans

- group plans

The RESP you choose may depend on how many beneficiaries you have, the age of the beneficiaries, and what you want to invest in. Your RESP provider can give you information about specific plans and help you choose the plan that is right for you.

| Criteria | Individual Plan | Family Plan | Group Plan |

|---|---|---|---|

| RESP Promoter | Banks, credit unions, mutual fund companies, investment dealers, insurance companies, and scholarship plan dealers | Scholarship or group plan dealers (non-taxable entities such as foundations or non?profit trusts) | |

| Subscriber | Can be:

|

||

| Beneficiary | One | One or more Must be related to subscriber by blood or adoption | One beneficiary named by subscriber but as part of a plan for many children |

| Age of beneficiary | No age limitation | Under age 21 at the time designated | May be specified by plan |

| Under age 31 at the time of contribution | |||

| Contributions | Subscriber decides when and how much to contribute up to the lifetime limit. Promoter may set minimum amount. | Subscriber decides when and how much to contribute up to the lifetime limit. Promoter may set minimum amount. | Regular contributions determined when you open the plan |

| Time limit for contributions | Up to 32nd year of plan (36th year for a specified plan) | Up to age 31 of each beneficiary | Contributions according to the plan schedule |

| Payout/withdrawals | Contributions: May be returned tax-free to the subscriber at any time or may be paid to or on behalf of a beneficiary to help finance education. However, if the beneficiary is not eligible for an EAP, grants and incentives may need to be returned to the government. | Contributions: Usually repaid to the subscriber when beneficiary reaches a certain age. | |

| EAPs: Some plans make EAPs on a set schedule, while others let you decide. | EAPs: Based on the total number of students of the same age who are in school that year, but government incentives are paid to specific beneficiaries | ||

| Plan closure | End of 35th year after the year the plan was entered (40th year for a specified plan) | End of 35th year after the year the plan was entered | Date for plan maturity is set at enrolment and is based on the beneficiary’s birth date |

When you create an individual or family plan, a separate trust is established for each plan. Individual plans allow only one beneficiary, whereas family plans are for one or more beneficiaries.

Individual and family plans are offered by many financial institutions including banks, credit unions, mutual fund companies, insurance companies, investment dealers, and scholarship plan dealers.

As a subscriber, you can decide when and how much you want to contribute (up to the lifetime limit per beneficiary). Alternatively, you can decide to suspend contributions at any time. The terms of the plan may set a minimum contribution amount. The plan may allow you to decide how to invest the funds in the plan or limit the investment options available.

Amounts paid into the plan under government incentive programs, as well as investment earnings that accumulate in the plan, are paid out as educational assistance payments (EAPs) to the beneficiary(s) when the beneficiary(s) are enrolled in a qualifying educational program.

- Established for only one beneficiary who must be a Canadian resident and have a valid Social Insurance Number (SIN).

- There are no restrictions on the age of the beneficiary.

- There are no restrictions on who can be named as beneficiary. A subscriber can be the beneficiary of their own plan.

- Anyone can be a subscriber and make contributions.

- Contributions can be made up to 31 years after the plan is opened (35 years for a specified plan[1]).

[1] A specified plan is an individual plan where the beneficiary is entitled to the disability tax credit for the taxation year that ends in the 31st year following the year that the plan was entered. A specified plan cannot permit another individual to be designated as a beneficiary under the RESP after the 35th year following the year the plan was entered.

- Established for one or more beneficiaries, who must be a Canadian resident, and have a valid SIN.

- Each beneficiary must be under the age of 21 when added to the plan.

- Each beneficiary must be related to the subscriber of the RESP by blood or by adoption.

- Where all beneficiaries are siblings, it is called a siblings only plan

- Contributions can be made until the beneficiary is 31 years old.

Group plans, also referred to as education funds or scholarship funds, are offered by scholarship or group plan dealers and are sold by prospectus. They are a set of individual plans that are administered on an age group concept. That is, all contracts for beneficiaries who are nine years old are administered together. The date the plan matures is set at the time of enrolment and is based on the beneficiary’s birth date.

Contributions to a group plan are calculated by the promoter’s actuary. The amount and frequency of these contributions stay the same as long as the beneficiary has not reached 18 years of age. Regular contributions throughout the term of the RESP are usually required, but each plan has its own rules.

Your savings are combined with those of other people and the earnings are shared when it is time to pay for school. Generally, when each plan matures, the contributions are returned to the subscriber and the earnings are divided among the beneficiaries who qualify to receive EAPs in each year of their post-secondary education. The amounts received by each beneficiary will differ as the government grants and incentives cannot be shared among the beneficiaries of a group plan.

If your beneficiary does not begin post-secondary studies at the same time as the rest of the group, the earnings received from the plan may be affected. If you drop out of the plan before it matures, you may forfeit your earnings to the group.

Note: It is important to read the plan’s prospectus to understand how the plan works.

Investments

An RESP may invest in a wide range of qualified investments such as stocks, bonds, and other popular securities including mutual funds, segregated fund contracts, and guaranteed investment certificates (GICs). In general, the types of property that qualify for an RESP are similar to those that qualify for an RRSP. The availability of some or all of these investment options will depend on your plan.

| Type of Plan | RESP Providers | Investment Options | Investment Decisions |

|---|---|---|---|

| Individual and Family Plans | Banks and credit unions | Savings accounts GICs Mutual funds | You and your advisor choose an appropriate mix of investments |

| Mutual fund companies | |||

| Insurance companies | |||

| Investment dealers | |||

| Group plans | Scholarship plan dealers | In general, a plan must invest in fixed-income securities, such as T-bills, GICs, and bonds | All of the investment decisions are made for you |

There is no restriction on foreign content held in an RESP. However, dividends paid on shares listed on a prescribed stock exchange in a foreign country may be subject to foreign withholding tax. Treaty relief for the withholding tax is generally not available.

If a non-qualified investment is acquired by your RESP, a penalty tax is equal to 50% of the fair market value of the investment at the time it was acquired or became non-qualified. The investment income from such investments is subject to an advantage tax equal to 100% of the income if the income is not withdrawn promptly. In addition, the CRA has the right to revoke any RESP that holds non-qualified investments.

Costs and Fees

Fees or charges for RESPs vary widely. Fees may depend on the plan provider, investment choices, and plan rules.[1] Fees may be charged for the following:

- Account opening. There is usually no charge to open an RESP, however some institutions may charge a nominal set-up fee.[2]

- Annual administration. There are often no annual fees for RESPs opened at a bank or a mutual fund company, however, the cost of plans at other institutions may vary. Plans may require an annual fee if the savings are below a threshold amount in the plan, or related accounts with the same financial institution, or have fees assessed as a trustee fees.

- Investment management. Different investments come with different types of costs to purchase or manage them. There may be commissions to purchase or sell market securities (such as stocks, bonds, ETFs, etc) held within a plan, or paid to an advisor to manage the investments. There may also be sales charge for the purchase, or sale. of mutual funds for your plan or when you sell them. Mutual funds also charge management expenses, expressed as a management expense ration (MER), for the mutual funds held in the plan.

- Other fees. Most plans charge additional fees for special services. For example, there may be fee to change the plan beneficiary or transfer money to another RESP.

For RESP accounts provided by a scholarship plan dealer, there will likely be other fees such as:

- Sales fees or commissions. Also called membership or enrolment fees. The salesperson and plan provider are paid commission when a plan is opened. These fees are typically non-refundable, after a 60 day recission period. if the plan is terminated early, or the beneficiary fails to continue with their education after high school.

- Annual fees. These may include administration fees, trustee fees and deposit fees.

- Other costs. Most plans charge additional fees or penalties. These may include, but are not limited to:

- fees for early withdrawal of contributions,

- fees to transfer the RESP to another RESP, or change the plan beneficiary.

- If you have a group plan, fees to change the payment schedule.

[1] Always discuss the fees with the plan advisor, review all RESP documents , and be clear on any situations that would result in additional fees on the account, before signing and opening the account.

[2] Some financial institutions offer low-fee or no-fee RESP accounts for Canadians living on low incomes.