Registered Education Savings Plan

A registered education savings plan, or RESP, is:

- a convenient way to save for future post-secondary education of a child, yourself, or another person;

- a tax‑assisted education savings plan (ESP), registered with the Canada Revenue Agency (CRA) to encourage investing for post‑secondary education; and

- a contract between the subscriber and a promoter (sometimes referred to as provider).

Under the contract, the subscriber names one or more beneficiaries (the future student(s)) and agrees to make contributions for them. The promoter agrees to pay educational assistance payments (EAPs) to the beneficiaries of the plan.

Contributions to an RESP are not tax deductible, but the investment in the plan will grow tax deferred until it is withdrawn for a post-secondary educational program. In addition, there are grants and incentives available from the Government of Canada and certain provinces to enhance investment for beneficiaries under the age of 18.

Contributors do not receive a tax deduction for investments in an RESP. There are no taxes due until funds are taken out to pay for a child’s education. At that time, contributions made into the RESP are returned tax-free, although contributors’ earnings from the plan and grants are taxed. However, since a large number of students have little to no income, many can withdraw the payments effectively tax-free.

Benefits

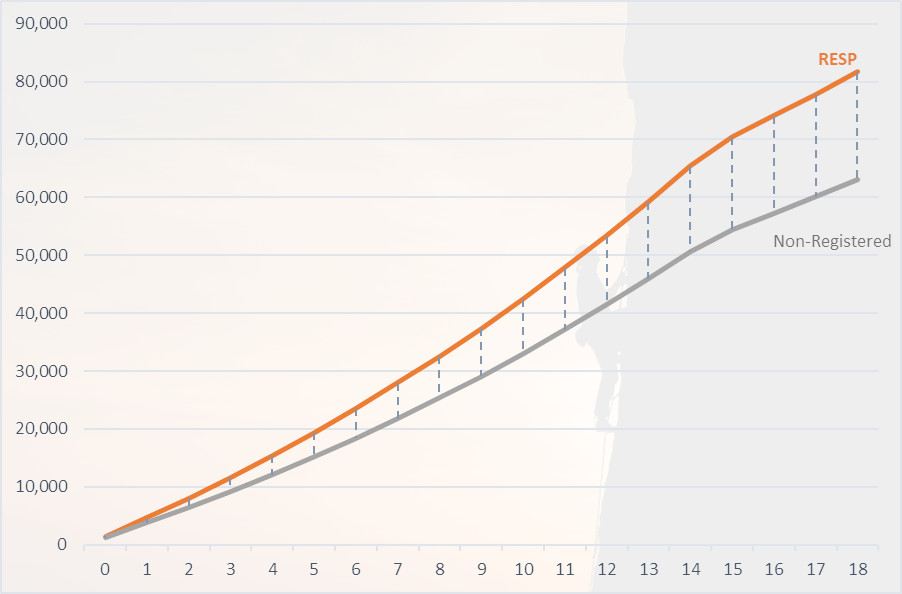

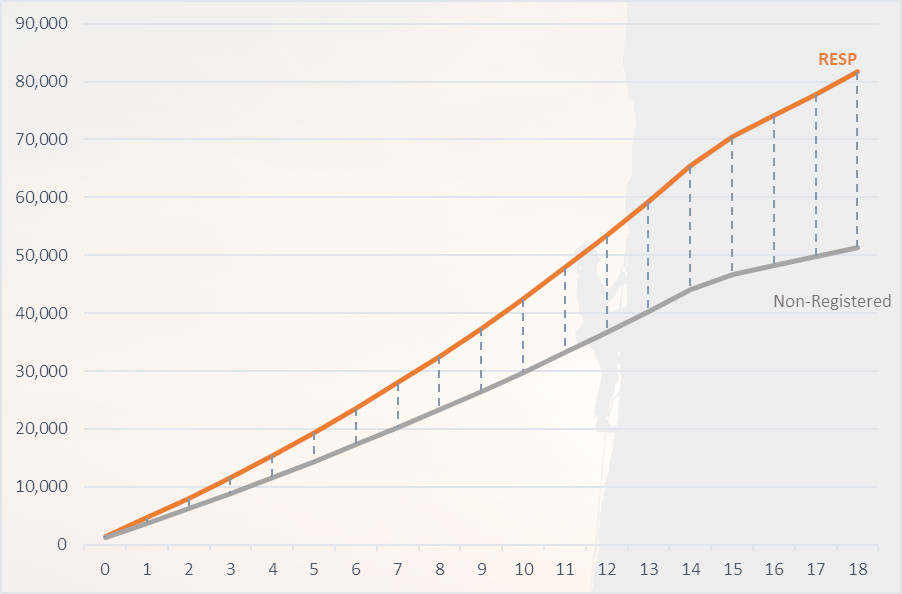

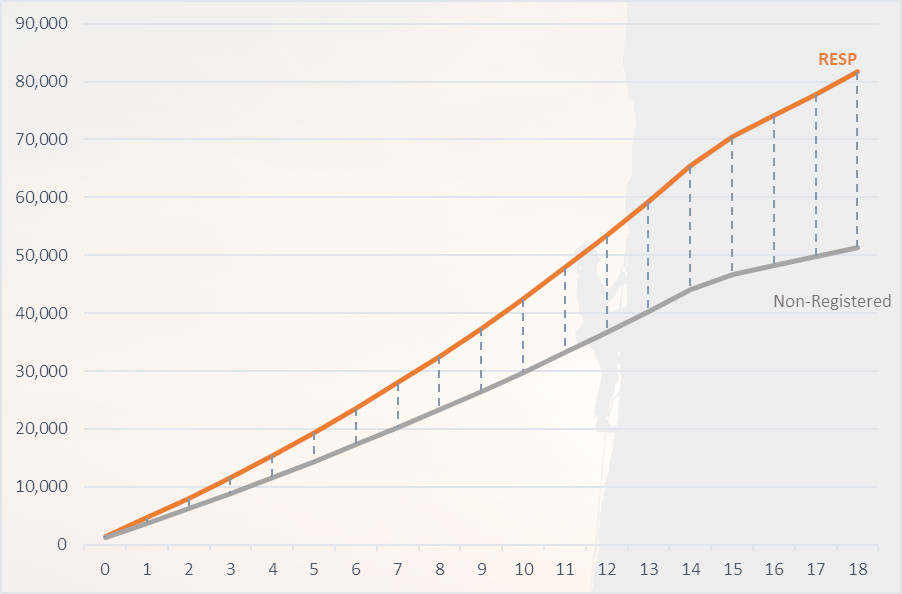

Income from investment in the RESP is tax-sheltered while it remains in the RESP.

-

Contributing $200 per month from age 6 months to age 14.5

-

Matching federal and QC grants

-

5% interest income

Grandparents, extended family, close friends, and anyone else willing to support can give towards the RESP.

When withdrawn for enrolment in a qualifying post-secondary educational program, plan growth, and government grants will be taxed at the student’s tax rate. Withdrawal of contributions is always tax-free.

Assumptions

- Contributions of $200 per month from age 6 months to age 15½

- 5% rate of return

- No taxes

Benefits

Benefits include:

Grandparents, extended family, close friends, and anyone else willing to support can give towards the RESP.

When withdrawn for enrolment in a qualifying post-secondary educational program, plan growth, and government grants will be taxed at the student’s tax rate. Withdrawal of contributions is always tax-free.

What To Look For

Subscriber be aware. Different RESP providers and plans have different features, risks, and costs. It is important to choose the plan that best suits your needs. Ask your RESP provider for information about the plans offered.

Understand what fees you may be expected to pay when you open the plan, as well as any other costs you may incur to continue participation in the plan, withdraw from, or to terminate the plan.

Make sure that your plan offers the grants that are available. All plans offer the basic CESG. However, not all plans support all the other government of Canada or provincial government grants.

Many plans allow you to decide when and how much to contribute, up to the lifetime limits, while other plans require you to make contributions according to a set schedule.

An RESP may invest in a wide range of qualified investments that carry different risks and rates of return. The availability of investment options will depend on your plan and provider.

To receive payments for post-secondary education from your plan, the student will need to provide proof of enrolment in a qualifying program, sometimes by a certain deadline.

Depending on your situation and the terms of your plan, you may have the following options:

- Leave the plan open—your beneficiary may decide to continue education at a later date.

- Use the money for another beneficiary or, under certain conditions, transfer a beneficiary’s RESP to a registered disability savings plan (RDSP).

- Close the plan.

Your contributions, less any fees or penalties, will be returned to you tax-free. Grants and incentives that remain in the plan will be returned to the applicable government. Under specific conditions, the earnings on the plan assets may be returned as taxable payments to you. You may be able to reduce or eliminate the tax by transferring money to your registered retirement savings plan (RRSP), or a spousal RRSP if you have available RRSP contribution room.